How Much Does a Property Tax Lawyer Cost? Ultimate 2025 Guide to Affordable Solutions

Dealing with property tax issues can feel overwhelming, especially when homeowners aren’t sure whether they need legal help or how much does a property tax lawyer cost. Understanding how much does a property tax lawyer cost and the expenses involved helps people make informed decisions about their property tax challenges. This guide breaks down everything property owners need to know about property tax lawyer costs and fee structures.

Understanding Property Tax Lawyers

Property tax lawyers specialize in helping property owners navigate complex tax situations, disputes, and appeals. These legal professionals understand local tax codes, assessment procedures, and how to challenge unfair property valuations. Before determining how much does a property tax lawyer cost, it’s important to understand what these professionals do.

When property owners receive tax bills that seem too high or face disputes with local tax assessors, a property tax lawyer can provide valuable guidance and representation. They work to protect property owners’ rights and ensure they’re paying fair and accurate property taxes. According to the American Bar Association, specialized tax attorneys bring critical expertise to property tax disputes that can make a significant difference in outcomes.

What Do Tax Attorneys Do?

Tax attorneys handle a wide range of services related to property taxation. Their expertise extends beyond simple consultations to include comprehensive legal representation.

These professionals review property tax assessments to determine if they’re accurate and fair. They research comparable properties in the area to build strong cases for appeals. When necessary, they represent clients at administrative hearings and in court proceedings.

Tax attorneys also help property owners understand exemptions they might qualify for, such as homestead exemptions, senior citizen discounts, or veteran benefits. The Internal Revenue Service provides guidelines on various tax-related matters, though property tax is primarily a local jurisdiction issue. These lawyers prepare and file all necessary paperwork, ensuring deadlines are met and documentation is complete.

Additionally, these lawyers negotiate with tax authorities on behalf of their clients, often securing reduced assessments or favorable settlements without going to court.

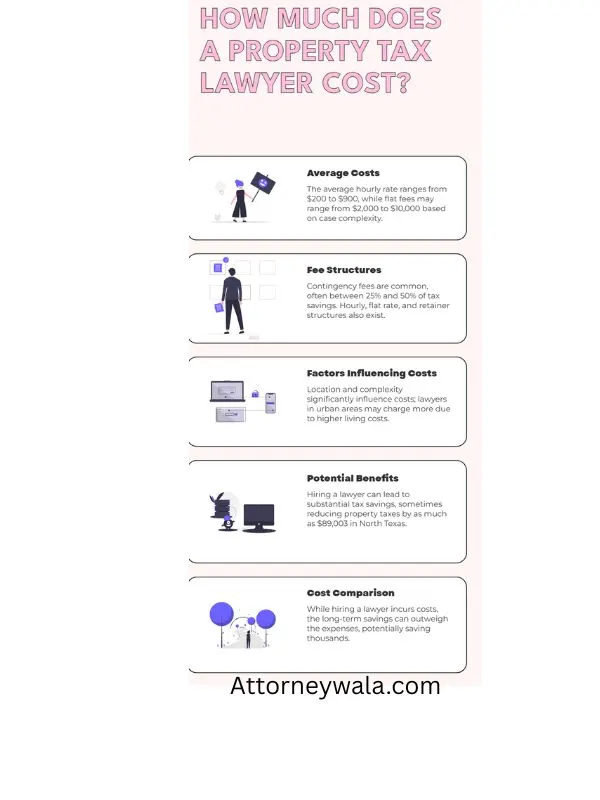

How Much Does a Property Tax Lawyer Cost?

Understanding how much does a property tax lawyer cost is crucial for budgeting and planning. The cost of hiring a property tax lawyer varies depending on several factors, including location, case complexity, and the attorney’s fee structure. Here’s a detailed breakdown of how much does a property tax lawyer cost based on different payment arrangements.

Hourly Rates

Many tax attorneys charge hourly rates, which typically range from $200 to $400 per hour. In major metropolitan areas or for highly experienced attorneys, rates can climb to $500 per hour or more. The National Association of Tax Professionals notes that rates vary significantly based on geographic location and attorney specialization.

Hourly billing works well for straightforward consultations or cases that require minimal time investment. However, costs can add up quickly if a case becomes complex or drawn out.

Flat Fees

Some property tax lawyers offer flat fee arrangements for specific services. A property tax appeal might cost anywhere from $1,500 to $5,000 as a flat fee, depending on the property’s value and the complexity of the appeal.

Flat fees provide predictability, allowing property owners to budget accurately for legal services. This arrangement is particularly popular for standard appeals and routine matters.

Contingency Fees

Property tax appeal lawyers often work on contingency, meaning they only get paid if they successfully reduce the property owner’s tax bill. Contingency fees typically range from 25% to 50% of the first year’s tax savings.

This arrangement appeals to property owners who want to minimize upfront costs and only pay for results. However, it’s important to understand exactly how savings are calculated and what percentage the lawyer will receive.

Retainer Agreements

For ongoing representation or complex cases, some attorneys require a retainer. This upfront payment, often $2,000 to $10,000, goes into a trust account and the lawyer bills against it as work is completed.

Factors That Affect Property Tax Lawyer Fees

When considering how much does a property tax lawyer cost, several elements influence the final price. Understanding these factors helps property owners estimate potential expenses more accurately.

Property Value: Higher-value properties often involve larger tax disputes, which can mean higher legal fees due to increased complexity and potential savings. Forbes regularly publishes insights on property valuation and tax assessment trends.

Case Complexity: Simple assessment appeals cost less than cases involving multiple properties, commercial real estate, or issues requiring extensive research and litigation.

Geographic Location: Lawyers in major cities typically charge more than those in smaller towns or rural areas, reflecting differences in cost of living and market rates.

Attorney Experience: Seasoned tax attorneys with proven track records often command higher fees than less experienced practitioners.

Timeline and Urgency: Rush cases or those with tight deadlines may incur premium rates.

When to Hire a Tax Attorney

Knowing when to bring in a property tax lawyer can save money and stress in the long run. The National Taxpayer Advocate emphasizes the importance of seeking professional help when facing complex tax situations.

Property owners should consider hiring an attorney when they believe their property has been overassessed and the potential tax savings exceed the legal costs. If a property’s assessed value increased dramatically without corresponding improvements or market changes, legal representation might be warranted.

Those facing complex situations, such as commercial property assessments, disputes over property classification, or issues with multiple taxing authorities, benefit from professional legal help.

When dealing with substantial amounts of money—where annual tax bills run into tens of thousands of dollars—the potential savings often justify legal expenses.

Additionally, if previous appeals were unsuccessful or if facing aggressive opposition from tax assessors, having experienced legal representation levels the playing field.

How Much Do Tax Lawyers Make?

While this information doesn’t directly impact hiring costs, understanding the profession provides context. Tax lawyers typically earn between $80,000 and $150,000 annually, with experienced attorneys in large firms or major cities earning significantly more. According to the Bureau of Labor Statistics, lawyers specializing in tax law are among the higher-earning legal professionals.

These earnings reflect the specialized knowledge and expertise required to navigate complex tax laws and regulations. The investment in legal education and ongoing professional development contributes to the fees these professionals charge.

Finding a Property Tax Lawyer Near You

Searching for a “property tax lawyer near me” yields local options, which offers several advantages. Local attorneys understand regional tax assessment practices, know the local hearing officers and judges, and can easily attend in-person meetings or hearings.

When searching for representation, property owners should look for attorneys who specialize specifically in property tax matters rather than general practice lawyers. The American Academy of Attorney-Certified Public Accountants maintains directories of qualified tax professionals. Check reviews on platforms like Avvo or Martindale-Hubbell, ask about their success rate with appeals, and request references from past clients.

Many property tax lawyers offer free initial consultations, providing an opportunity to discuss the case, understand potential outcomes, and get clear information about costs before making a commitment.

What Type of Lawyer Do You Need for Property Disputes?

Property tax issues differ from other property disputes. While boundary disputes, easement issues, or landlord-tenant matters require real estate attorneys, tax assessment challenges specifically call for tax attorneys or property tax specialists.

These professionals focus exclusively on tax-related matters and understand the nuances of property valuation, assessment procedures, and tax appeal processes that general practice attorneys might not.

Maximizing Value When Hiring a Property Tax Lawyer

To get the most value from legal representation, property owners should come prepared with organized documentation, including current and historical tax assessments, appraisals, and information about comparable properties.

Being responsive to the attorney’s requests and communicating clearly about goals and concerns helps cases move efficiently, potentially reducing billable hours.

Understanding the fee structure upfront and getting everything in writing prevents surprises and ensures both parties have clear expectations.

Is Hiring a Property Tax Lawyer Worth It?

After understanding how much does a property tax lawyer cost, the next question is whether the investment is worthwhile. The decision to hire a property tax lawyer depends on potential savings versus costs. For properties with annual tax bills of $10,000 or more, even a small percentage reduction can result in significant savings that far exceed legal fees.

Property owners should calculate potential savings by determining how much their taxes might decrease if their assessment is successfully challenged. If the potential first-year savings exceed the attorney’s fees by a comfortable margin, hiring representation makes financial sense.

Beyond immediate financial considerations, having professional representation reduces stress, saves time, and increases the likelihood of a successful outcome. Tax attorneys know how to present compelling cases and navigate procedural requirements that might trip up property owners representing themselves. Resources like Nolo provide additional legal information, though professional representation often yields better results in complex cases.

Conclusion

Understanding how much does a property tax lawyer cost empowers property owners to make smart decisions about their tax challenges. The question of how much does a property tax lawyer cost doesn’t have a single answer, as fees vary based on location, complexity, and fee structure. However, the investment often pays for itself through reduced tax assessments and long-term savings.

Whether dealing with a questionable assessment, planning an appeal, or facing a complex tax dispute, consulting with a qualified property tax attorney provides clarity about options and potential outcomes. Many offer free initial consultations, making it easy to explore whether legal representation makes sense for a specific situation and to get a clear answer about how much does a property tax lawyer cost for individual circumstances.

Taking action on property tax concerns sooner rather than later protects property owners’ rights and can result in substantial long-term savings.

Frequently Asked Questions

How much does it cost to hire a tax attorney for a property tax appeal?

The cost typically ranges from $1,500 to $5,000 for a flat fee arrangement, or $200 to $500 per hour for hourly billing. Many property tax appeal lawyers work on contingency, charging 25% to 50% of the first year’s tax savings, which means property owners only pay if the appeal succeeds.

What do tax attorneys do for property owners?

Tax attorneys review property assessments for accuracy, research comparable properties to build appeal cases, represent clients at hearings, and negotiate with tax authorities. They also identify tax exemptions property owners might qualify for and handle all paperwork and deadlines related to property tax disputes.

When should someone hire a tax attorney?

Property owners should consider hiring a tax attorney when their property appears overassessed, when potential tax savings exceed legal costs, for complex commercial property issues, or when facing substantial tax bills. Legal representation is also valuable if previous appeals were unsuccessful or when dealing with aggressive tax assessors.

Do property tax lawyers offer free consultations?

Many property tax lawyers offer free initial consultations. These meetings allow property owners to discuss their case, understand potential outcomes, and get clear information about costs before making a commitment to hire the attorney.

How much do tax lawyers typically make annually?

Tax lawyers generally earn between $80,000 and $150,000 per year, with experienced attorneys in large firms or major metropolitan areas earning significantly more. These earnings reflect the specialized knowledge required to navigate complex tax laws and property valuation issues.

What’s the difference between hourly rates and contingency fees?

Hourly rates require payment for all time the attorney spends on the case, typically $200 to $500 per hour. Contingency fees mean the lawyer only gets paid if they successfully reduce the property tax bill, taking a percentage of the savings. Contingency arrangements minimize upfront costs but may result in higher total fees if the appeal is very successful.

Can a regular real estate lawyer handle property tax appeals?

While real estate lawyers handle property transactions and disputes like boundary issues, property tax appeals require specialized knowledge of tax law, assessment procedures, and valuation methods. A property tax attorney or tax specialist is better equipped to handle assessment challenges than a general real estate lawyer.

How long does a property tax appeal take?

The timeline varies by jurisdiction but typically ranges from three to twelve months. The process includes filing the appeal, gathering evidence, potentially attending a hearing, and waiting for a decision. An experienced property tax lawyer can provide a more accurate timeline based on local procedures.

What documents should someone bring to a property tax lawyer consultation?

Property owners should bring current and historical property tax assessments, recent appraisals, information about comparable properties in the area, photos of the property, and details about any property damage or issues that might affect value. Having organized documentation helps attorneys assess the case quickly.

Are property tax lawyer fees tax deductible?

In many cases, legal fees paid for tax advice and representation related to investment or rental properties may be tax deductible as business expenses. However, fees related to personal residence tax appeals typically are not deductible. Property owners should consult with a tax professional about their specific situation.

What success rate do property tax lawyers have?

Success rates vary by attorney, jurisdiction, and case specifics, but experienced property tax lawyers often achieve favorable outcomes in 60% to 80% of cases. During initial consultations, property owners should ask about the attorney’s track record and success rate with similar cases.

Is it worth hiring a property tax lawyer for a small tax increase?

It depends on the numbers. If annual property taxes are under $5,000 and the increase is modest, self-representation might make more sense. However, for properties with taxes exceeding $10,000 annually, even a small percentage reduction can justify legal fees, especially with contingency arrangements that minimize risk.