Does Health Insurance Cover ATV Accidents? 7 Essential Facts Every Rider Must Know

All-terrain vehicles (ATVs) have become increasingly popular for recreational activities and work purposes. However, with this popularity comes an important question that many riders ask: “Does health insurance cover ATV accidents?” Understanding whether health insurance covers ATV accidents is crucial for anyone who rides or is considering purchasing an ATV. This comprehensive guide explores does health insurance cover ATV accidents and provides essential information every rider needs to know.

According to the Consumer Product Safety Commission, ATV-related injuries have been steadily increasing, making it more important than ever to understand your insurance coverage options.

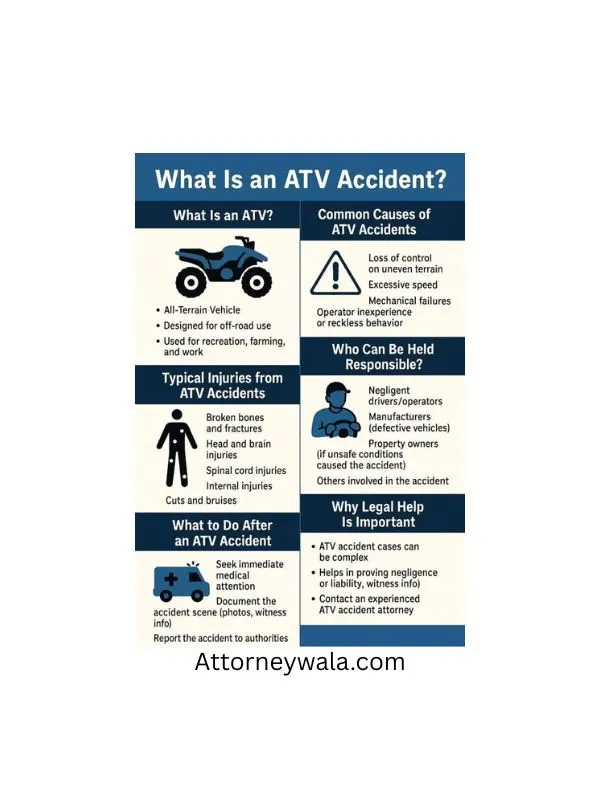

What Is an ATV Accident?

An ATV accident refers to any incident involving an all-terrain vehicle that results in property damage, personal injury, or both. These accidents can range from minor scrapes and bruises to severe injuries requiring extensive medical treatment. ATV accidents can occur during recreational riding, work-related activities, or even while transporting the vehicle.

Common types of ATV accidents include:

- Rollovers due to steep terrain or sharp turns

- Collisions with trees, rocks, or other obstacles

- Falls from the vehicle while riding

- Accidents involving multiple ATVs

- Incidents caused by mechanical failures

Does Health Insurance Cover ATV Accidents? The Truth Revealed

The answer to whether health insurance covers ATV accidents is not straightforward and depends on several factors. Most standard health insurance policies will cover medical expenses resulting from ATV accidents, but there are important considerations to keep in mind when determining does health insurance cover ATV accidents.

The National Association of Insurance Commissioners provides guidelines that help clarify when health insurance coverage applies to recreational vehicle accidents, including ATV incidents.

Standard Health Insurance Coverage for ATV Accidents

Generally speaking, health insurance treats ATV accident injuries like any other accidental injury. This means that emergency room visits, hospital stays, surgeries, and follow-up care related to ATV accidents are typically covered under standard health insurance policies. However, when considering does health insurance cover ATV accidents, riders should always verify their specific policy details, as coverage can vary between insurers.

For detailed information about health insurance coverage requirements, the U.S. Department of Health and Human Services offers comprehensive resources about what standard health plans must cover.

Potential Coverage Limitations for ATV Accidents

Some health insurance policies may have exclusions for certain high-risk activities. While ATV riding is not universally excluded, some insurers may classify it as a hazardous activity, potentially affecting whether health insurance covers ATV accidents. Additionally, if an ATV accident occurs while the rider is under the influence of alcohol or drugs, health insurance coverage might be denied.

The Insurance Information Institute provides detailed explanations about policy exclusions and limitations that may affect coverage for recreational vehicle accidents.

Understanding ATV Insurance vs. Health Insurance Coverage

While health insurance may cover medical expenses from ATV accidents, dedicated ATV insurance serves a different purpose and offers additional protection. Understanding the difference is crucial when evaluating does health insurance cover ATV accidents versus comprehensive ATV protection.

For specific information about ATV insurance requirements by state, visit the National Highway Traffic Safety Administration website, which provides updated regulations and safety guidelines.

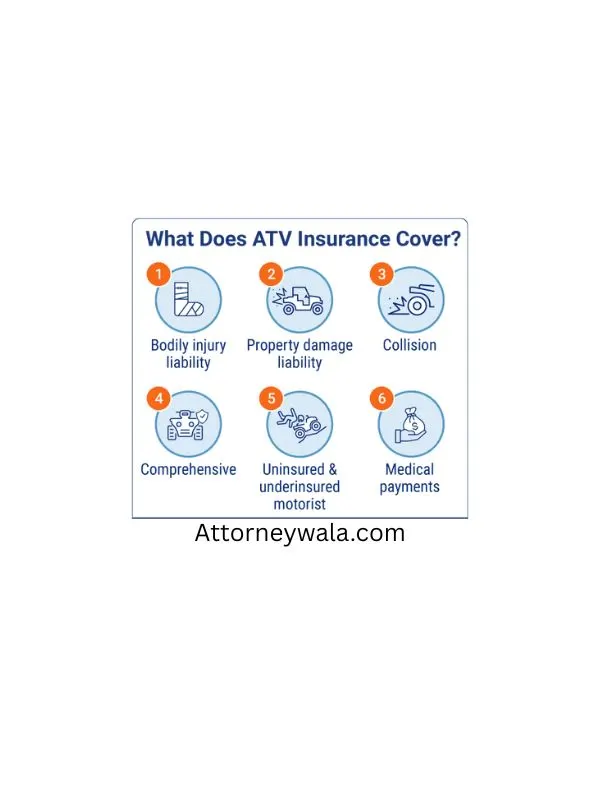

What Does ATV Insurance Cover?

ATV insurance typically includes:

- Liability coverage for damages to others

- Property damage protection

- Collision coverage for the ATV itself

- Comprehensive coverage for theft or weather damage

- Medical payments coverage for injuries to the rider and passengers

Do I Need ATV Insurance?

Whether someone needs ATV insurance depends on several factors:

- Legal requirements: Some states require ATV insurance for registration or operation on public lands

- Financing requirements: Lenders typically require insurance on financed ATVs

- Personal financial protection: ATV insurance protects against costly liability claims and vehicle damage

The Average Cost of ATV Insurance

The average cost of ATV insurance varies based on multiple factors, but riders can generally expect to pay between $100 to $500 annually for basic coverage. Factors affecting cost include:

- The ATV’s value and model

- The rider’s age and experience

- Coverage limits and deductibles

- Geographic location

- Intended use (recreational vs. work)

Filing an ATV Insurance Claim

When an ATV accident occurs, filing an insurance claim promptly is essential. The process typically involves:

- Immediate steps: Ensure everyone’s safety and seek medical attention if needed

- Documentation: Take photos of the accident scene and gather witness information

- Notification: Contact the insurance company as soon as possible

- Cooperation: Work with adjusters and provide requested documentation

- Follow-up: Stay in communication throughout the claims process

Does Homeowners Insurance Cover ATV Accidents?

Many people wonder if their homeowners insurance provides any coverage for ATV accidents. In most cases, homeowners insurance offers limited coverage for ATVs, typically only when the vehicle is on the insured property. This coverage is usually minimal and may not extend to liability protection for accidents occurring elsewhere.

For comprehensive protection, dedicated ATV insurance is generally recommended rather than relying on homeowners insurance coverage.

When to Consult an ATV Accident Lawyer or Attorney

There are situations where consulting with an ATV accident lawyer or attorney becomes necessary:

Legal Representation May Be Needed When:

- Serious injuries result in significant medical expenses

- Multiple parties are involved in the accident

- Insurance companies dispute coverage or claim amounts

- Product liability issues arise from ATV defects

- Accidents occur on someone else’s property

An experienced ATV accident attorney can help navigate complex insurance issues, negotiate with insurance companies, and ensure that injured parties receive appropriate compensation for their damages.

Finding ATV Accident Support Near You

For those searching for “ATV accident near me” resources, several options are available:

- Local personal injury attorneys specializing in ATV accidents

- Insurance agents familiar with ATV coverage

- Medical professionals experienced in treating ATV-related injuries

- ATV safety organizations and training programs

Prevention and Safety Measures

While understanding insurance coverage is important, preventing ATV accidents should be the primary focus. Riders can reduce their risk by:

- Wearing appropriate safety gear, including helmets

- Taking ATV safety courses

- Following manufacturer guidelines for weight limits and terrain

- Avoiding riding under the influence

- Maintaining their ATV in good working condition

People Also Ask (FAQ)

Will my health insurance deny coverage for ATV accident injuries?

Most health insurance policies will not automatically deny coverage for ATV accident injuries, as they treat these incidents like any other accidental injury. However, the question “does health insurance cover ATV accidents” becomes more complex when coverage may be denied if the accident occurred while under the influence of substances or if the policy specifically excludes high-risk recreational activities.

The American Medical Association provides resources about medical coverage for accident-related injuries and patient rights regarding insurance claims.

What happens if I don’t have ATV insurance and cause an accident?

Without ATV insurance, riders become personally liable for all damages and injuries they cause. This could result in significant out-of-pocket expenses, including medical bills for injured parties, property damage, and potential legal fees. In some states, operating an ATV without required insurance can also result in fines and legal penalties.

Can I use my car insurance for ATV accidents?

Standard auto insurance policies typically do not cover ATV accidents, as ATVs are classified differently from regular motor vehicles. Some auto insurance companies offer separate ATV coverage, but riders cannot rely on their car insurance to protect them during ATV-related incidents.

Are ATV accidents covered under workers’ compensation?

If an ATV accident occurs while performing work-related duties, it may be covered under workers’ compensation insurance. This often applies to agricultural workers, utility workers, or others who use ATVs as part of their job responsibilities. However, coverage depends on the specific circumstances and employer policies.

How much does it cost to treat ATV accident injuries?

The cost of treating ATV accident injuries varies widely depending on the severity of the injuries. Minor injuries might cost hundreds of dollars, while serious injuries requiring surgery, extended hospital stays, or rehabilitation can result in medical bills exceeding tens of thousands of dollars. This is why having proper insurance coverage is crucial.

Do I need special licensing to operate an ATV?

ATV licensing requirements vary by state and location. Some states require safety certificates or special licenses for ATV operation, especially for younger riders or when operating on public lands. Many areas also have age restrictions and helmet requirements for ATV riders.

What should I do immediately after an ATV accident?

After an ATV accident, riders should first ensure everyone’s safety and call emergency services if anyone is injured. Document the scene with photos, gather witness information, and notify insurance companies promptly. Seeking medical attention even for seemingly minor injuries is recommended, as some injuries may not be immediately apparent.

Can ATV accidents affect my regular health insurance premiums?

Generally, filing claims for ATV accident injuries should not directly impact health insurance premiums, as most health insurance pricing is based on broader risk pools rather than individual claim history. However, when considering does health insurance cover ATV accidents, patterns of high-risk behavior might be considered during policy renewals or when switching insurers.

For more information about health insurance pricing and factors that affect premiums, visit Healthcare.gov, the official government resource for health insurance information.

Conclusion: Making Smart Decisions About ATV Insurance Coverage

Understanding whether health insurance covers ATV accidents requires careful review of individual policy terms and conditions. While most health insurance plans will cover medical expenses from ATV accidents, riders should not rely solely on health insurance for comprehensive protection. The question “does health insurance cover ATV accidents” has been thoroughly explored in this guide, revealing that while basic medical coverage often applies, additional protection is essential.

Investing in dedicated ATV insurance provides broader coverage, including liability protection and vehicle damage coverage that health insurance doesn’t offer. The relatively modest cost of ATV insurance compared to the potential financial exposure from accidents makes it a wise investment for most ATV owners.

For additional safety resources and ATV operation guidelines, consult the ATV Safety Institute, which offers comprehensive training programs and safety information for riders of all experience levels.

Before heading out on your next ATV adventure, take the time to review your insurance coverage and consider consulting with insurance professionals to ensure you have adequate protection. Remember, while insurance provides financial protection, no coverage is better than safe riding practices that prevent accidents from occurring in the first place.

This article is for informational purposes only and should not be considered legal or insurance advice. Readers should consult with qualified insurance professionals and legal advisors for guidance specific to their situations.

so much good info on here, : D.